Fixed Deposit Interest

Investment Amount

- Fixed Deposit maturity amount can be calculated using the FD Calculator in a simple manner using the below steps: Customer will have to select the Customer Type i.e. Normal or Senior Citizen; Select the type of Fixed Deposit i.e. Cumulative or Interest Payout (Quarterly/Monthly) or Short Term FD.

- A fixed deposit (FD) is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular savings account, until the given maturity date.It may or may not require the creation of a separate account. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, India and The United States, and as a bond in the United Kingdom.

Minimum – 10,000MMK

Maximum – No Maximum Limit

AYA Time Deposit is ideal for the individual who has excess cash for an extended period of time. The account is opened for a particular fixed period (time) by depositing particular amount (money) and withdrawal is only allowed at the end of the particular period.

BENEFITS

Fixed Deposit Interest Rates In these times of uncertain returns, fixed deposits have become the most preferred banking instruments for planning a financially worry-free future for the family. Which is why Mahindra Finance’s Fixed Deposit scheme has been specially designed to assure you of guaranteed returns at highly competitive interest. What Is A Fixed Deposit Account? A Fixed Deposit account (FD) is a financial instrument offered by banks, which allows you to save your money for a fixed period of time to generate higher interest compared to a conventional savings account. In many western countries, FD is also known as term deposit or time deposit. A long-term, tax-free savings account, which offers a fixed interest rate which is higher, depending on how much you save.

- Extremely safe

- Higher Interest Rate

- Guaranteed returns

- Fixed Deposit may be pledged to the bank for loans

- Choose the scheme you want

ELIGIBLITY

Anyone who is Myanmar citizen and over 18 years can open AYA Time Deposit account.

- Individual or Joint

- Public Company Limited

- Sole Proprietorship/ Private Company Limited

- Joint venture

- Corporation

- Non Profit Corporation

Keep Your Documents Ready…

Individual

- NRC Number

Corporate

- NRC Number of the authorized person

- BOD Resolution (Meeting minutes)

- Form -6, Form -26, Form E

- Certificate of Incorporation

- Business License

- Memorandum and Articles Of Association

- Export/Import License

INTEREST RATES AND PERIODS

Fixed Deposit Interest Rates

You may choose the convenient period of Time Deposit to gain interest.

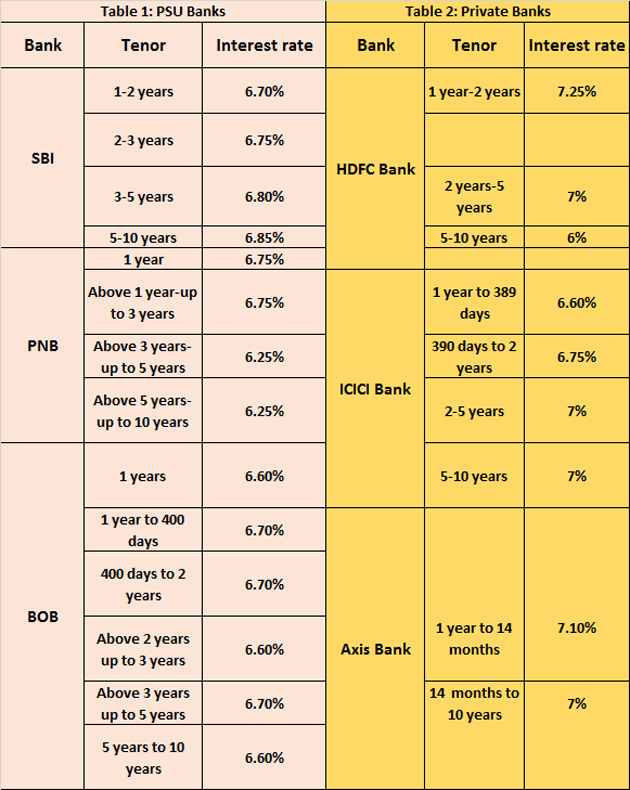

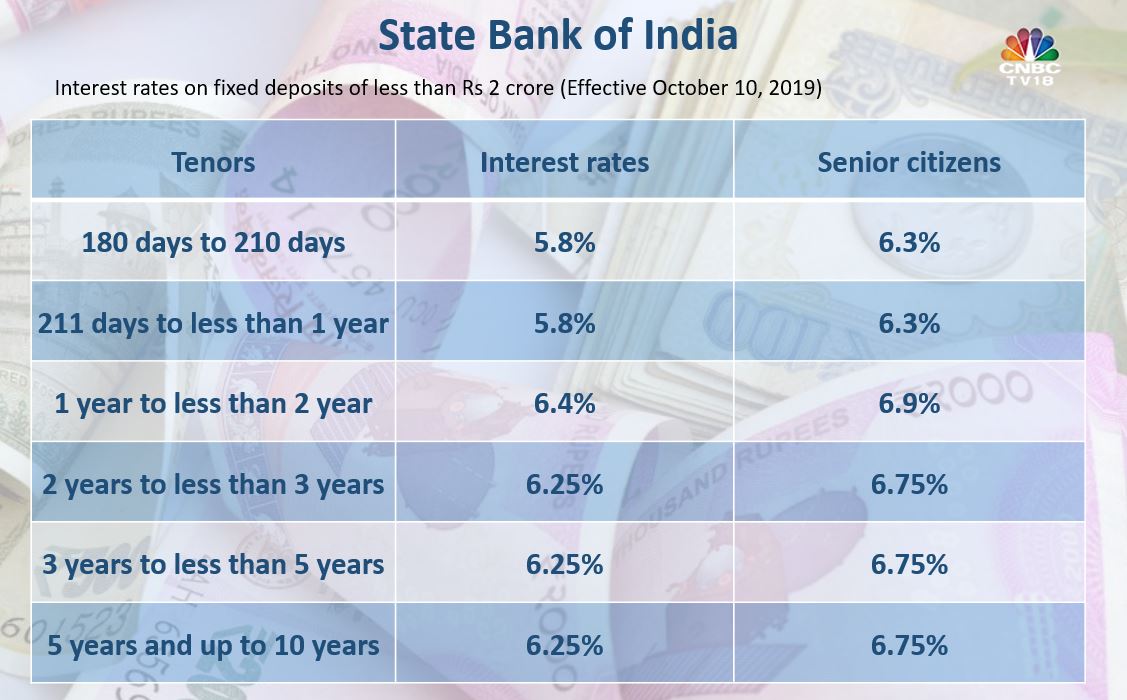

Fixed Deposit Interest Rate In Indian Banks

- 1 Month Time Deposit – 7.00% P.A

- 3 Months Time Deposit – 7.25% P.A

- 6 Months Time Deposit – 7.50% P.A

- 9 Months Time Deposit – 7.75% P.A

- 12 Months Time Deposit – 8.00% P.A

- 24 Months Time Deposit – 8.50% P.A