Andhra Bank Fixed Deposit Rates

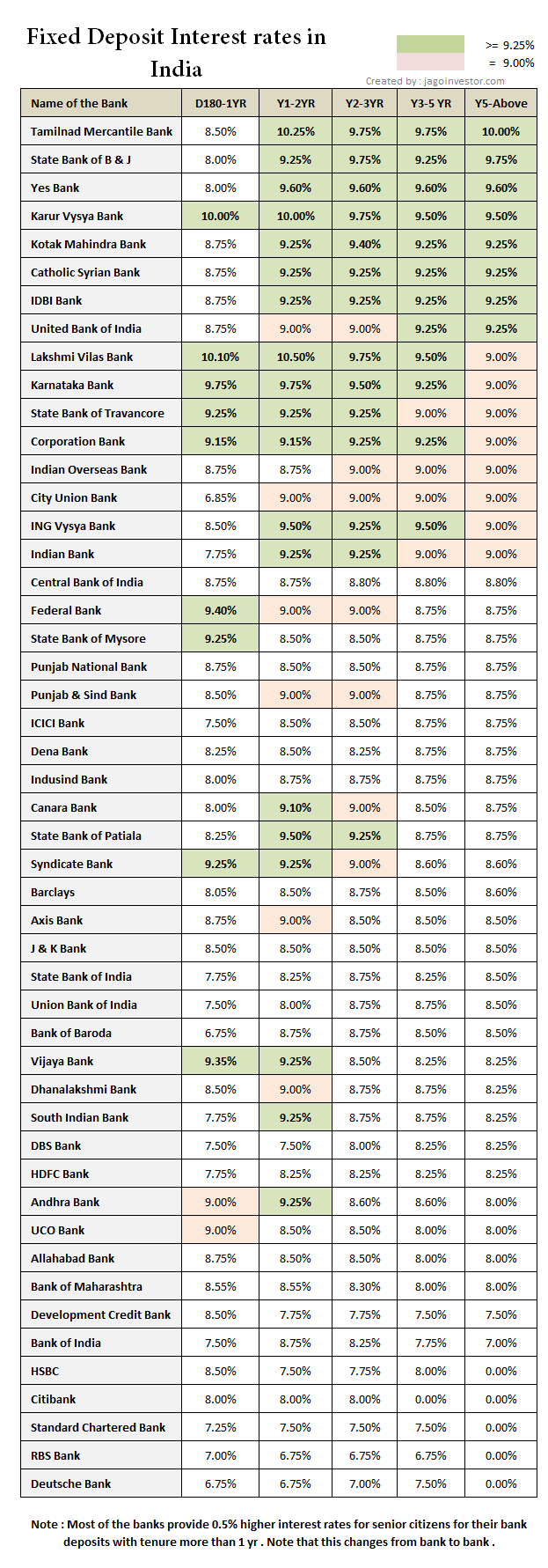

- Fixed Deposit Interest Rates In Andhra Bank

- Sbi Fixed Deposit Interest Rate

- Andhra Bank Fixed Deposit Interest Rates

- Andhra Bank Fixed Deposit Rates 2019

Interest Rate on Andhra Bank Fixed Deposit The rate of interest paid on a fixed deposit varies according to the amount deposited, period and the issuing bank. Andhra Bank interest rates typically range from 4% to 7% per annum. Andhra Bank Fixed Deposit rates. In this guide you will find the procedure which you need to follow to open fixed deposit in Andhra Bank offline process and not online. The minimum tenure or term period for which you can make Fixed Deposit is 7 days. The maximum tenure or term period is 10 Years.

New and Attractive Interest Rates

w.e.f. February 18, 2021

| Tenure | < Rs. 2 crores | |

| Interest Rate | Interest Rate for Senior Citizens* | |

| 181 - 270 Days | 3.65 | 3.65 |

| 271 - 1 Yr | 3.85 | 3.85 |

| > 1 Yr - 1.5 Yrs | 4.00 | 4.00 |

| > 1.5 Yrs - 2 Yrs | 4.25 | 4.25 |

| 5 Yrs | 6.00 | 6.00 |

Please note :

- Interest Rate per annum (%).

- Special interest rates quoted above are applicable for deposits of value less than Rs. 2 crores only.

- These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of monthly interest payout, interest shall be calculated for the quarter and paid monthly at a discounted rate in line with RBI directives.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year

NRE Fixed Deposit Rates

w.e.f. February 18, 2021

| Tenure | Interest Rate per annum (%) |

| 1 Yr | 3.85 |

| > 1 Yr - 1.5 Yrs | 4.00 |

| > 1.5 Yrs - 2 Yrs | 4.25 |

| > 2 Yrs - 3 Yrs | 4.50 |

| > 3 Yrs - 4 Yrs | 5.00 |

| > 4 Yrs - < 5 Yrs | 5.25 |

| 5 Yrs | 6.00 |

- Initial minimum fixed deposit size is Rs. 20,000.

- Premature withdrawal:

For Single Deposit of less than Rs. 2 crores

• Less than 1 year : no interest

• 1 year & above : In case of premature withdrawal of fixed deposits, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals - Interest rates are subject to change without prior notice.

- These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year

Domestic / NRO Fixed Deposit Rates

w.e.f. February 18, 2021

| Tenure | < Rs. 2 crores | |

| Interest Rate | Interest Rate for Senior Citizens* | |

| 7 Days | 1.80 | 1.80 |

| 8 - 14 Days | 1.80 | 1.80 |

| 15 - 29 Days | 2.50 | 2.50 |

| 30 Days | 3.00 | 3.00 |

| 31 - 45 Days | 3.00 | 3.00 |

| 46 - 59 Days | 3.00 | 3.00 |

| 60 - 89 Days | 3.25 | 3.25 |

| 90 - 99 Days | 3.50 | 3.50 |

| 100 Days | 3.25 | 3.25 |

| 101 - 180 Days | 3.25 | 3.25 |

| 181 - 270 Days | 3.65 | 3.65 |

| 271 Days - 1 Yr | 3.85 | 3.85 |

| > 1 Yr - 1.5 Yrs | 4.00 | 4.00 |

| > 1.5 Yrs - 2 Yrs | 4.25 | 4.25 |

| > 2 Yrs - 3 Yrs | 4.50 | 4.50 |

| > 3 Yrs - 4 Yrs | 5.00 | 5.00 |

| > 4 Yrs - < 5 Yrs | 5.25 | 5.25 |

| 5 Yrs | 6.00 | 6.00 |

Please note :

- Interest Rate per annum (%).

- Special interest rates quoted above are applicable for deposits of value less than Rs. 2 crores only.

- No interest is payable for deposits withdrawn prematurely before 7 days.

- Premature withdrawal

In case of premature withdrawal of fixed deposits on 7th day or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals. - Minimum fixed deposit amount is Rs. 20,000.

- Interest Rates are subject to change without prior notice.

- The following interest payout options available for the customer

• Monthly

• Quarterly

• Cumulative - *Applicable only for Retail Deposits - Resident Indian Senior Citizens i.e. Resident Individuals of age

60 years & above and excludes Non-Resident individuals, Individuals in their capacity as a Karta in HUFs and all non individuals. Incase of joint accounts the first holder should be a senior citizen to avail of these rates. - These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of monthly interest payout, interest shall be calculated for the quarter and paid monthly at a discounted rate in line with RBI directives.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year

Domestic / NRO and NRE Fixed Deposit Rates greater than or equal to Rs. 2 crores

For rates greater than or equal to Rs. 2 crores please click here

Fixed Deposit Interest Rates In Andhra Bank

Interest rates for deposits greater than or equal to Rs. 2 crores are updated on a daily basis and interest rates updated on a Friday are valid for the following Saturday and Sunday. In case of non-updation of today’s interest rate, please revisit later to check the updated rates.

Please note :

- Interest Rate per annum (%).

- Interest Rates are subject to change without prior notice.

- No interest is payable for Resident / NRO deposits withdrawn prematurely before 7 days.

- No interest is payable for NRE deposits withdrawn prematurely before 1 year.

- Premature withdrawal for Resident / NRO deposits

In case of premature withdrawal of fixed deposits on 7th day or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the card rate for deposits greater than or equal to Rs. 2 crores as on the date of booking and for the period for which the deposit has run. This will be applicable for all deposits including renewals. - Premature withdrawal for NRE deposits

In case of premature withdrawal of fixed deposits on 1 year or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the card rate for deposits greater than or equal to Rs. 2 crores as on the date of booking and for the period for which the deposit has run. This will be applicable for all deposits including renewals. - The following interest payout options available for the customer

• Monthly

• Quarterly

• Cumulative - These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of monthly interest payout, interest shall be calculated for the quarter and paid monthly at a discounted rate in line with RBI directives.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year.

Interest Rates for Recurring Deposit

w.e.f. February 18, 2021

| Maturity Period | Interest Rate | Interest Rate for Senior Citizens* |

| 12 months | 3.85 | 3.85 |

| 15 months to 18 months | 4.00 | 4.00 |

| 21 months to 24 months | 4.25 | 4.25 |

| 27 months to 36 months | 4.50 | 4.50 |

| 39 months to 48 months | 5.00 | 5.00 |

| 51 months to 57 months | 5.25 | 5.25 |

| 60 months | 6.00 | 6.00 |

Please note :

- Minimum ticket size of Rs. 5,000 to a maximum of Rs. 200,000.

- Minimum tenure of 12 months (in multiplies of 3 months thereafter).

- Maximum tenure of 60 months.

- The interest on Recurring Deposits will be calculated by the bank in accordance with the directions advised by Indian Banks' Association.

- Interest on Recurring Deposits will be paid out on maturity.

- Premature withdrawal:

In case of premature withdrawal of recurring deposits, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals. - If the Recurring Deposits is broken within 14 days from the date of booking, no interest will be paid.

- Interest Rates are subject to change without prior notice.

- Partial withdrawal is not allowed for recurring deposits.

- In case an installment is failed, SI failure charges as per schedule of charges will be applicable.

- *Applicable only for Retail Deposits - Resident Indian Senior Citizens i.e. Resident Individuals of age

60 years & above and excludes Non-Resident Individuals, Individuals in their capacity as a Karta in HUFs and all non individuals. Incase of joint accounts the first holder should be a senior citizen to avail of these rates. - These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year.

Apply for Fixed Deposit

SMS FD to 561615

Call 18602666601#

#Customers outside India need to dial +91 22 6601 6601. Customers in Mumbai can also call at +91 22 6601 6601. Call charges apply.

Useful Information

•Loan Interest Certificate

•EMI Calculator

•Pay Tax Online

•Create IPIN Online

•Verified By Visa (VBV)

•Schedule of charges

•Fixed / Recurring Deposit Calculator

•Important Information

•Safe Banking

•Digital Signature Certificate

•Financial Results

•Privacy Policy

•Do-Not-Call Service

•Customer Feedback

•Positive Pay

•About Us

•Form Centre

•ATM / Branch Locator

•Awards

•Sitemap

IN THIS ARTICLE

- Andhra Bank Deposits Schemes

Andhra Bank provides its customers a variety of deposit schemes to their Andhra Bank Account holders. The rate of interest for the different deposit schemes varies depending upon the period of deposits, already prevailing rates of interest and the rules set by government. Senior citizens have an extra benefit of 0.05% interest for the recurring deposits.

Andhra Bank Types of Deposits

The variety of deposit schemes offered by the bank are, AB Shubh Yatra (Holiday Saving Account), AB Recurring Plus, AB Freedom (Flexi) deposit scheme, AB Tax Saver, AB Fixed deposits, AB Kalpataruvu deposits, AB Recurring deposits, and AB Smart Choice.Other Banks like IndusInd Bank Deposits and Union Bank Of India Depositsalso providing different type of Deposits same as the Andhra Bank.

You Can Also Check Here For Better Banking Experience

Andhra Bank Deposits Interest Rates

There is a much difference in between one scheme to another scheme. Andhra Bank Interest Rates are vary from one scheme to another scheme. For AB Recurring Plus, it is as per term deposit rates, for AB Freedom (Flexi) deposit scheme, it is at local term deposit rates for units converted to term deposits, for AB Money Time it varies from 4 to 6.5% for deposit below 1.00 crore and 4 to 5.75% for above 1.00 crore and below 10.00 crores and the maturity period varies from 7 days to 10 years, for AB Tax Saver it is 7.75% and the maturity period is 5 years, for AB Kalpataruvu deposits it is same as AB Money Time, for AB Recurring deposits it depends on various inputs such as the maturity period or deposit period and the amount accumulated in the account at the time of applying interest rates on a quarterly basis, and for AB Smart Choice, it is 4%, 4%, 4.25%, and 5% for deposited amount from 1.00 Crore to 10.00 Crore, for maturity periods of 7 days to 14 days, 15 days to 45 days, 46 days to 90 days, and 91 days to 179 days respectively. HDFC Bank Deposits, South Indian Bank Deposits and Allahabad Bank Deposits are also providing different deposit schemes depends on the period of deposit.

Sbi Fixed Deposit Interest Rate

You Can Also Check Andhra Bank Cards

Andhra Bank Deposits Schemes

The variety of deposit schemes offered by the bank are explained as follows.

AB Shubh Yatra (Holiday Saving Account) which is a scheme planned by Andhra Bank in collaboration with M/s Thomas Cook India to present a savings plan for your holidays.

AB Recurring Plus is to accumulate the savings of the depositors over a period to meet future emergencies.

AB Freedom (Flexi) deposit scheme which is term deposit and savings accounts combined to provide better benefits to customers who wish to save the invested money for longer periods.

AB Recurring deposits and AB Smart Choiceis a type of fixed deposit with higher deposit amount requirement of 1 crore or higher and the term of the deposit is only 179 days.

AB Money Time is a monthly income deposit scheme that forms an aggregate amount to provide the customer with regular income.

AB Tax Saver is a scheme planned for customers to avail tax benefits under the notifications of the union government.similar to Andhra Bank,United Bank of India Deposit Schemes also provides the different schemes to their customers

AB Fixed deposits is scheme provided by the bank to enable investors to get higher rate of interest on their savings compared to a regular savings account.

AB Kalpataruvu deposits is a cumulative term deposit which has a minimum deposit amount set. For more details you can also check here for other Banksrelated information.

Andhra Bank Fixed Deposit Interest Rates

FAQ’s Related to Andhra Bank Deposits

Andhra Bank Fixed Deposit Rates 2019

- What is the minimum and maximum period of the Deposit?The minimum and maximum periods of deposits are 7 days and 179 days respectively.

- Is the Rate of Interest fixed for all the Schemes?No, the rate of interest varies from time to time and is decided by the headquarters.